SPRINGFIELD — After an incarcerated man named Eddie Thomas died alone in a prison infirmary without receiving any end-of-life care, State Senator Adriane Johnson is championing legislation to bring dignity, compassion, and transparency to hospice and palliative care services in Illinois correctional facilities.

“This bill is about basic human dignity,” said Johnson (D-Buffalo Grove). “No one should die in pain, in isolation or without the comfort of care — no matter who they are or where they live. House Bill 2397 brings transparency to a system that too often leaves people to suffer silently.”

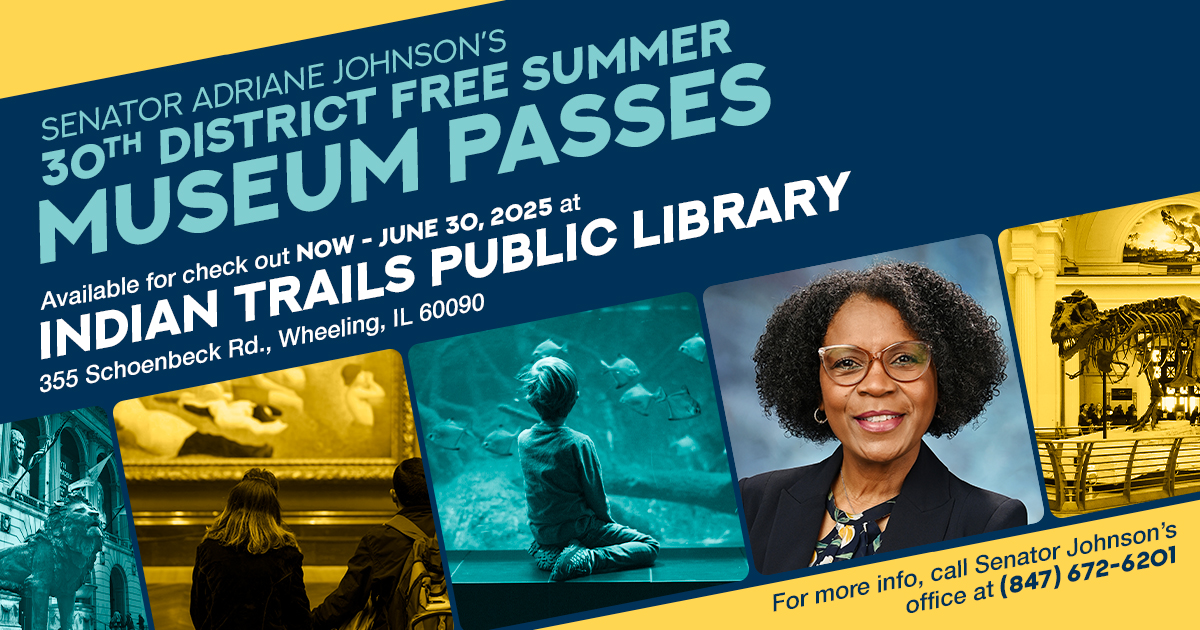

BUFFALO GROVE — To help local families access cultural and educational opportunities this summer, State Senator Adriane Johnson is once again offering free museum passes to 30th District residents through a partnership with the Indian Trails Public Library in Wheeling.

“Every child and family should be able to experience the wonder of discovery, whether it’s learning about our planet at a science museum or exploring history and art up close,” said Johnson (D-Buffalo Grove). “These passes remove financial barriers and help connect our community to world-class institutions right in our own backyard.”

SPRINGFIELD – State Senator Adriane Johnson advocated for a package of legislation designed to foster healthier learning environments, enhance access to mental health care, and expand educational and job opportunities for some of Illinois’ most vulnerable populations during a subject matter hearing Tuesday.

“Whether it’s supporting a student’s mental health, improving the air they breathe in classrooms, or helping young adults get on the path to a good-paying job, we must continue to invest in the people and systems that shape our communities,” said Johnson (D-Buffalo Grove). “These bills are about access, equity, and building a better Illinois for all.”

SPRINGFIELD — To ensure all students receive equitable access to school counseling and support services, State Senator Adriane Johnson championed a measure to clarify that school counselors are permitted to serve all students, regardless of their immigration or citizenship status.

“Every student deserves access to trusted adults and supportive services in their school,” said Johnson (D-Buffalo Grove).

Page 8 of 80